If you are a real estate investor, you’ve likely considered investing in a rental property here in the State of Florida. All eyes are on the sunshine state as rental property investments continue to look ever attractive. As residents from around the nation flock to Florida, rental rates continue to soar.

Florida is experiencing a trifecta of economic growth, low unemployment rate, and population growth, not to mention fantastic weather! That all sounds great, but if you are an out-of-state real estate investor, how do you choose the right market to purchase your rental property?

As a full-service property management company, we deal with and analyze rental property assets all day, every day. We are an investment group based out of Orlando, Florida, that specializes in Orlando property management. We are principally experienced in the single-family and multi-family rental market. We believe Florida’s diverse economy offers the best investment opportunities in the country right now. We have done the research. In this article, you will learn statistics, relevant information, see examples and our opinion of Florida’s best cities for buying a rental property.

1. Orlando

Our first and favorite real estate rental market is Orlando, Florida. People and businesses are moving to the greater Orlando area due to quality of life and work opportunities. According to Roofstock, “46% of housing units in Orlando are occupied by renters.” This is an immense amount of the renter population, and real estate investors love it.

The rental market in the Greater Orlando area is on fire. If you located an investment property that fits your criteria, you could expect it to have multiple offers, offers over asking price, or sold in hours after being listed. The real estate market is Tight, and the prices are high, but this is not stopping real estate investors from scooping up rental property assets. According to the Orlando Regional Realtor Association, The Orlando area inventory is down 50% from 6,825 homes in February 2020 to 3,420 homes in February 2021, according to appraisal firm Goodman Research. The slower sales rate is one sign that home values in Central Florida are not recovering quickly from anemic sales after the severe recession. Although home values in many Orange and Osceola counties are still increasing, more families choose to rent rather than buy a home as they look for cheaper living costs, tighter inventory, and more robust demand for area services, including groceries, shopping & health care. As a professional Orlando property management company, we are excited about Orlando, Florida’s future rental market and investment opportunities.

Orlando Metro area statistics:

The current metro area population of Orlando in 2021 is 2,002,000, a 1.93% increase from 2020, According to MacroTrends.

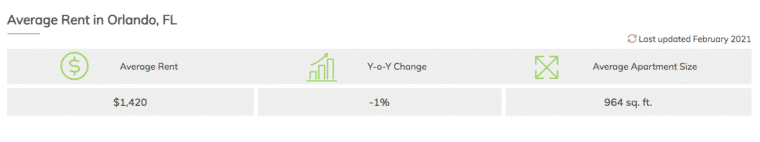

- The average rental rate in Orlando, Florida, is $1,420/mth, according to RentCafe.

Graph courtesy of RentCafe.

The median household income for Orlando area residents is $51,757. According to the United States Census Bureau.

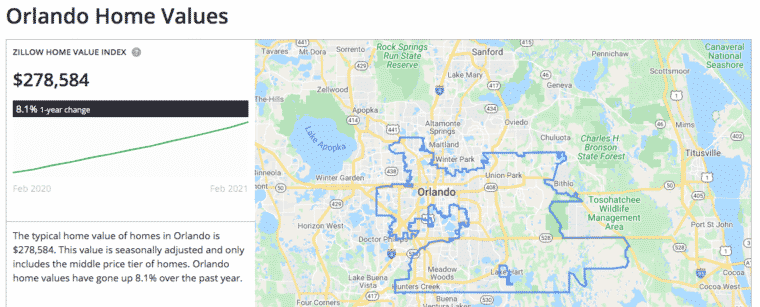

- According to Zillow, Orlando’s average home price is $278,584.

Courtesy of Zillow.

Courtesy of Zillow.

Rental Property Analysis Orlando:

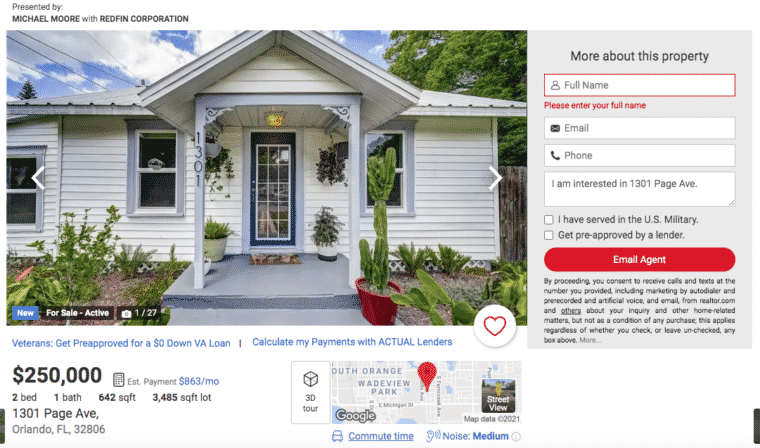

For example, take the property we found on the Local MLS and Realtor.com.

Courtesy of Realtor.com.

Courtesy of Realtor.com.

This property is located in Orlando’s desired location, located in our list of Top 5 Areas to Buy a Rental Property in Orlando. Our estimated rental rate for this property is $1,850/mth. If you do the math, this home is a great property to invest in potentially.

Purchasing a rental property in the Greater Orlando area is competitive. Still, if you find a property and act on it quickly, it is a secure market to be invested in.

2. Tampa

Tampa is a beautiful city in Florida to be invested in. According to Graystone Investment Group, “Tampa continues to rank as one of the best cities in the U.S. for real estate investing, with a booming economy and strong job growth, along with affordable investment properties featuring generous cash flow and equity growth.”

Tampa is ripe for future population growth, and we are single-handedly seeing a huge renter population. Rental property in the greater Tampa area will not sit vacant for very long. According to Roofstock, the population growth in Tampa was 1.7% last year and is projected to increase 3.3% annually over the next few years. Home sales statistics from Greater Tampa Realtors show low inventory and rising real estate prices.

Tampa Metro area Statistics:

The current metro area of Tampa is 2,911,000, a 1.18% increase from 2020. According to MacroTrends.

- The average rental rate in Orlando, Florida, is $1,420/mth, according to RentCafe.

Courtesy of RentCafe.

The Median household income for Tampa area residents is $54,599. According to Data USA.

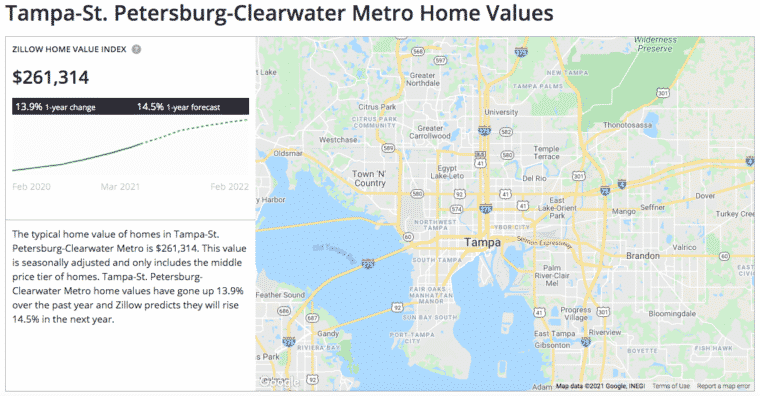

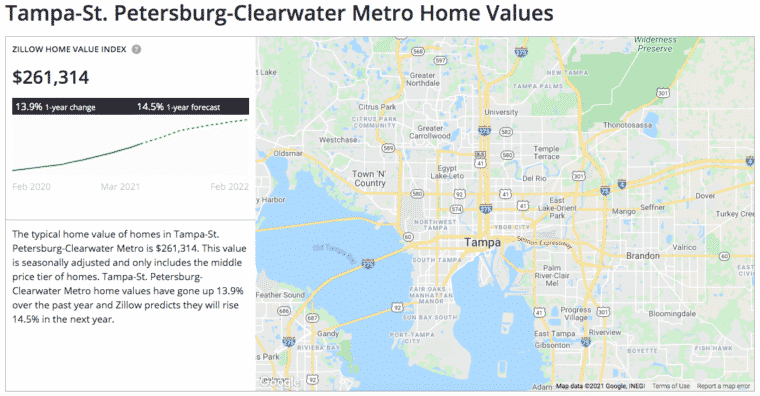

- According to Zillow, Tampa’s average home price is $261,314.

Courtesy of Zillow.

Rental Property Analysis Tampa:

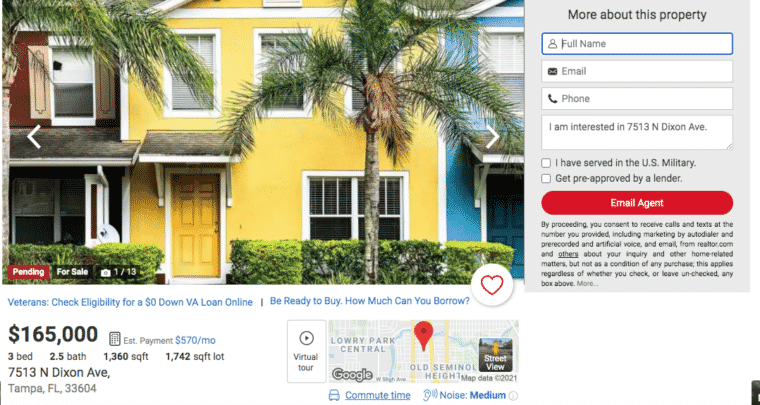

For example, take the property we found on the Local MLS and Realtor.com.

Courtesy of Realtor.com.

This property is located in Seminole Heights, which is an excellent location for a cheap purchase price. With a bit of TLC, this property can rent at around $1,300/mth. Rental rates can fluctuate significantly in the Tampa Metropolitan area, but you can still find excellent deals if you are looking for cash flow.

Tampa, Florida, will continue to produce excellent rental rates and benefit from the high population growth.

- If you are looking for the best Tampa Real Estate Agent, Tatum Praise, is an expert in the Tampa, Florida real estate market. Tatum Praise Premier Real Estate was voted the best real estate agent by Tampa Magazine! Our rental property managers refer all of our Tampa real estate investors to Tatum and her team. Contact Tatum and her team today for investing in Tampa Bay, Florida.

3. Jacksonville

Jacksonville, Florida, is a beautiful location to invest in real estate. It is a niche market that many real estate investors overlook. Jacksonville Business Journal expresses the real estate rental market is vital due to residents flocking to the area seeking a suburban lifestyle, cheaper and more affordable homes, and living.

Like all other markets in Florida, Jacksonville is experiencing a significant inventory shortage. Real estate investors will need to be aggressively seeking rental properties and submitting multiple offers. According to Jacksonville.com, “The Northeastern Florida real estate market is hotter than it has ever been.”

The city of Jacksonville has a thriving business district with many businesses and opportunities for job seekers. Besides, the city’s housing market has an ideal environment for investors, especially for turnkey real estate investments. Experts predict a positive trend shortly, and buying a Jacksonville property appears to be a profitable investment.

Jacksonville Metro area statistics:

The current metro area population of Jacksonville is 1,297,000, According to MacroTrends.

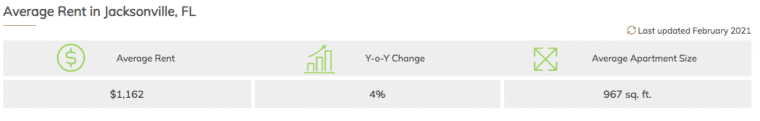

- The average rental rate in Jacksonville, Florida, is $1,162/mth, according to RentCafe.

Courtesy of RentCafe.

Courtesy of RentCafe.

The median household income for the Jacksonville area is $54,701. According to the United States Census Bureau.

- According to Zillow, Jacksonville’s average home price is $218,194.

Rental Property Analysis Jacksonville:

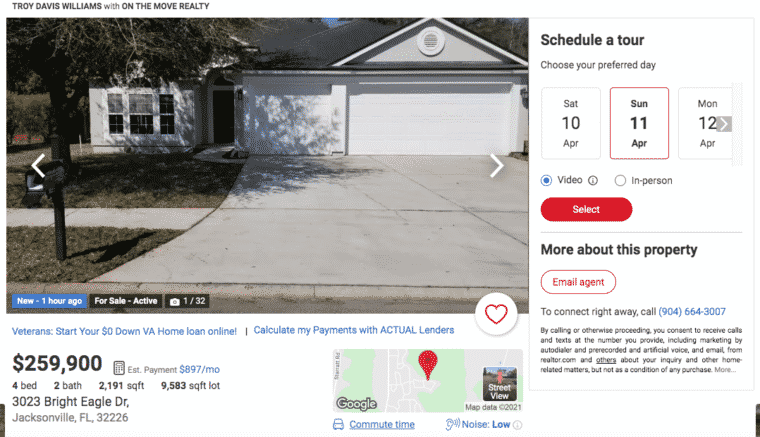

For example, take the property we found on the Local MLS and Realtor.com.

Courtesy of Realtor.com.

Courtesy of Realtor.com.

This potential rental property investment in Jacksonville fits the perfect specs for a large renter population. Featuring Four Bedrooms and 2 Bathrooms, it will lease extremely quickly for top dollar. We expect a property like this to rent around $1,950/mth.

4. Fort Myers

Fort Myers has made our list of best cities to buy a rental property because of the affordability and expected growth in years to come. According to The Walton Sun, “Cape Coral, Lehigh Acres, and Fort Myers stand out for strong growth in both their population and number of local businesses. All three cities have top-50 rates in these metrics out of the 500 total cities analyzed.” The economy and real estate market are booming in the southwest and specifically Fort Myers.

The rental market is also desirable for local and out-of-state real estate investors. According to Roofstock, the hot real estate market is pushing demand for rental properties, along with a high student population, young professionals seeking job opportunities.

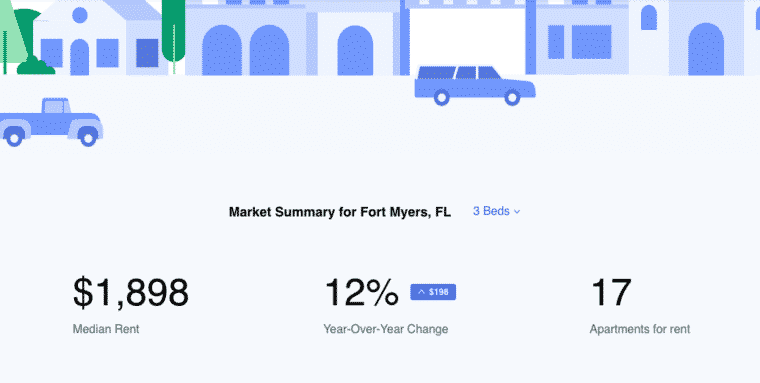

According to Zumper, Three Bedroom single-family homes and apartments average rental rate in Fort Myers is $1,898/mth. With only 17 available rental units in the Fort Myers area, the rental market is highly competitive. The renter population must pay high rental rates to secure their rental home.

Fort Myers Metro area statistics:

- The current population of the Cape Coral-Fort Myers metro is 700,165. According to Best Places.

- Three Bedroom single-family homes and apartments average rental rate in Fort Myers is $1,898/mth.

Courtesy of Zumper.

Courtesy of Zumper.

The median household income for the Jacksonville area is $43,474. According to DataUSA.

- According to Zillow, Fort Myers’s average home price is $237,452.

Rental Property Analysis Fort Myers:

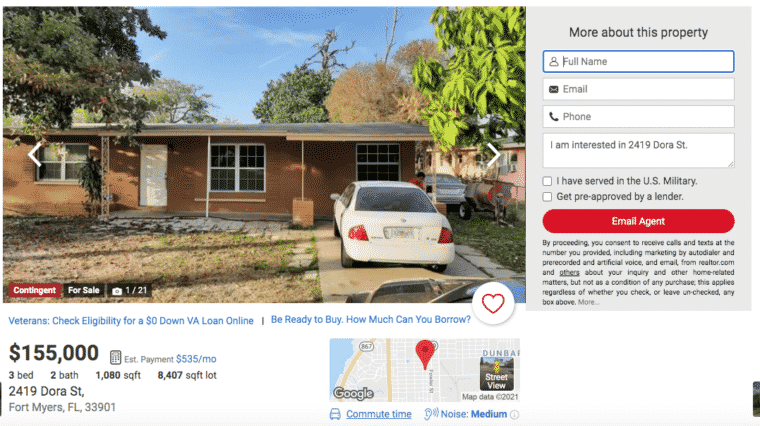

For example, take the property we found on the Local Fort Myers MLS and Realtor.com.

Courtesy of Realtor.com

Courtesy of Realtor.com

This property is located just south of Downtown Fort Myers in a neighborhood called Southward Village. This home is exceptionally well priced and fits the perfect three bed, two bath specs that investors and renters enjoy. This property (with repairs & TLC) will rent in the range of $1,300-$1,450/mth due to the neighborhood and area, although still making it an excellent rental property asset.

Why Invest in Florida Rental Properties?

Florida rental property investing is looking strong in 2021. It will continue to strive ahead of many other states in the U.S. If you are a real estate investor looking at the Florida rental market, we highly recommend doing so. But what are the driving factors behind Florida rental property growth?

Population

Economic Growth

Cost of Living

Quality of Life

Our top cities mentioned above are excellent markets in Florida to look at, although, with all of Florida booming, investors should consider other rental markets as well.

Why Purchase in Florida with a Property Management Company?

If you are looking for a long-term rental property in the State of Florida, you’ll want to use a property management company to assist. As an Orlando property management company, we have seen first hand that a real estate investor oftentimes has much more success using a rental property management company to evaluate their potential Florida investment property.

Property managers will provide a Free Rental Analysis and insight whether your Florida investment will be successful.

Property Managers Conclusion

We deal with rental property investors and landlords every day, from local State of Florida investors to real estate investors worldwide. We have seen the intensity and growth of rental rates and the new renter prospect pool. In Florida, when we have a vacant property, we receive inquiries from prospective tenants from around the U.S. We see rental property demand through the roof, and this is pushing rental rates higher.

Are you ready to invest in a Florida rental property? Reach out to us today, and we’d be glad to point you in the right direction. As a full-service property management company in Orlando, Florida, we specialize in managing Central Florida rental properties. Still, we have an excellent real estate agent network with Florida Realtors and Property Management professionals. Cheers!