With hundreds of tourist attractions, a thriving economy, and an influx of residents, the Orlando metropolitan area is dynamic and ever changing, making it one of the most competitive rental markets in the United States. The continuous stream of tourists, snowbirds, and residents contribute to a high demand for rental properties and the constant evolution of the rental market and price trends.

Orlando rental properties can be one of the most prosperous assets, however, such a dynamic market calls for two essential elements: knowledge of the market, and flexibility. With so many factors influencing the nature of the Orlando market, it is essential to stay on top of price trends and prepare to adjust your property accordingly.

While Orlando rental properties are lucrative investments, facing challenges is inevitable as a rental property owner and manager. One of the most significant challenges of owning a rental property is dealing with vacancies and price adjustments. Many property owners struggle with the idea of adjusting their property’s rental price, even when the vacancy period surpasses the average vacancy rate. There is a big debate on whether a price adjustment or a vacancy is a bigger expense; as a professional rental property manager, I’m here to provide some insight into the truth behind the expenses of price adjustments vs vacancies.

What is a Rental Price Adjustment in Orlando?

A price adjustment is a common tactic used to increase traffic and decrease vacancy rates for your rental property. A price adjustment is exactly what it sounds like: changing the price of your property while it’s on the market for rent. Price adjustments are a beneficial tactic implemented to stay current with market trends and find a reliable tenant in a timely manner. Price adjustments can save you from significant financial loss and ensure a steady income flow.

What is a Vacancy in Orlando?

A vacancy is when your rental property does not have any tenants. Vacancies occur for a number of reasons, some including inaccurate rental price, decrease in rental demand, or simply because of the end of your prior tenant’s lease term. It’s normal for your rental property to experience vacancy at some point in time, however, prolonged vacancies are a significant expense and detriment to your success as a rental property owner.

Reasons for Price Adjustments

Market Fluctuations and Tenant Demand

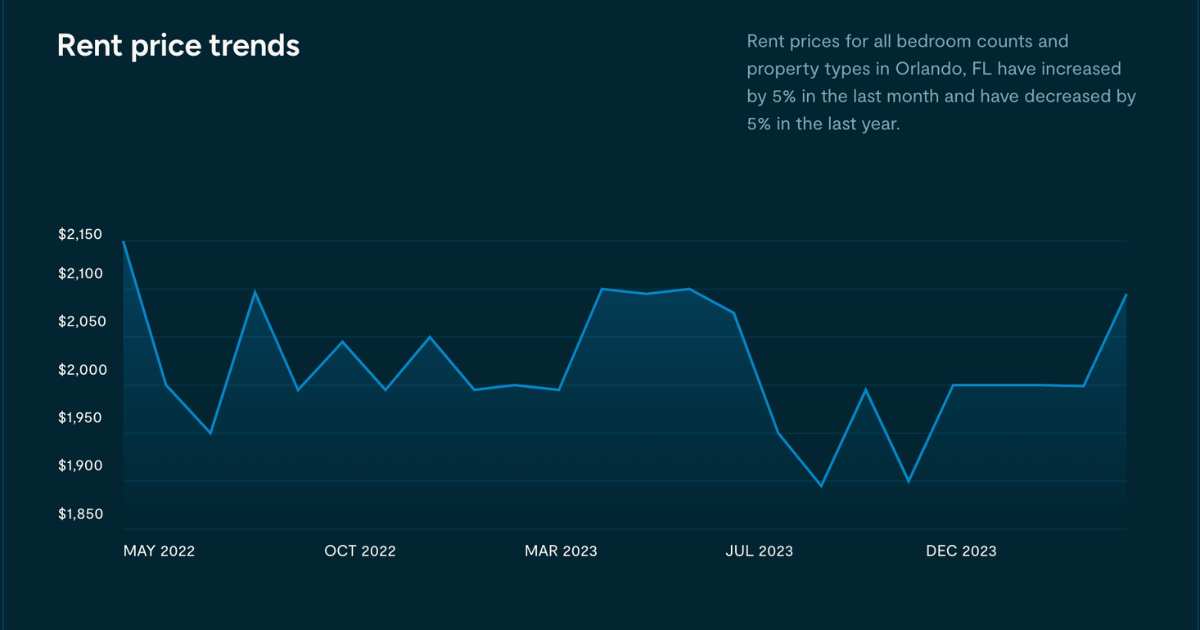

Market fluctuations are common in a rental market like Orlando — there are numerous factors that affect the condition of the market and create a need for flexibility and price adjustments.

Orlando is known for its world class theme parks like Walt Disney World and Universal, in addition to a booming economy and plethora of job opportunities, drawing in 74 million tourists in 2023, a population increase of 1.45% for a total population of 2,101,000, and a typical 5% population increase in the winter months. The constant influx of people results in ongoing changes in rental demand and average rental prices alike.

In addition to typical market changes, it is essential to consider the effects of extreme and unpredictable situations that can influence the state of the Orlando rental market. For example, the COVID-19 pandemic created a steep increase in rental demand and price changes. While Orlando rental property owners were able to boost rent prices during this time period, the end of the pandemic stabilized the rental market, bringing prices back down and calling for price adjustments. Other factors like a struggling economy or a natural disaster can also have an impact on rental prices and demand.

Orlando Rental Property Condition

Another factor that contributes to the need for price adjustments is property conditions. When cities like Orlando continue to grow in population and economic stability, more and more rental units are added to the market. Oftentimes, these units are new construction with modern interior, luxury amenities, and community aspects. This typically raises renters’ expectations of what kind of home they are looking for, and the price point in which they can do so.

Your rental property does not have to be new construction to attract and retain tenants, however, it’s important to keep in mind that the condition of your property will determine the price in which it gets rented. Similar comparable properties play a large role in determining the correct price for your property. For example, if your house is a 2-bed 2-bath single-story home with a backyard, you will want to consider the price of other recently rented 2-bed 2-bath single-story homes with a backyard. If similar rentals in your area have updated interiors, advanced technology, higher curb appeal, or luxury amenities, it is essential to take that into account. Properties in better or newer conditions will rent for a higher price per month.

If your Orlando property is older and sitting vacant, there are two choices to consider. One is upgrading your property. Popular upgrades include:

- Fresh paint

- New appliances

- New flooring

- Enhance Curb appeal

The other option is to adjust the rental price. If your property is sitting vacant for an extended period of time while others are renting, it is time for a price adjustment. If your property is priced the same as a similar property with a pool and updated stainless steel appliances, tenants are most likely going to choose the updated property.

Price adjustment vs Vacancy: Which is the Bigger Expense?

Many property owners are hesitant to adjust the price of their property, even when it has been sitting vacant for weeks or months at a time. This hesitancy comes from the misconception that adjusting the price is more of an expense than a vacancy. However, vacancies are an extreme expense and can cause significant income loss. In comparison to renting your property at an adjusted price, vacancies bring in zero money and leave you with no income to pay your bills.

While your property sits vacant, your property expenses do not get put on pause; taxes, mortgage payments, HOA payments, and utility costs continue with or without a tenant. Let’s break it down further:

What is the Expense of a Vacant Rental Property Orlando?

When debating between a price adjustment and a continued vacancy, it is essential to calculate the expense of your vacancy. Look at it this way: say your property has a $1,500 estimated rental rate and a $1,250 per month PITI (Principal / Interest / Taxes / Insurance) mortgage, plus utility expenses. A vacancy can cost in terms of days on market:

- 15 Days = $750 in lost rent + $625 mortgage + $100 in utilities =$1,475

- 30 Days = $1,500 in lost rent + $1,250 mortgage + $125 in utilities =$2,875

- 45 Days = $2,250 in lost rent + $1,875 mortgage + $150 in utilities =$4,275

- 60 Days = $3,000 in lost rent + $2,500 mortgage + $200 in utilities =$5,700

As the vacancy time increases, so do your expenses. The expense of just 30 days of vacancy can add up quickly and cause significant financial loss. This can be easily avoided with a price adjustment and correct rental price analysis. We know it can be difficult to determine the correct rent price, so at The Listing, we offer a FREE rental price analysis! Our rental price analysis can help avoid significant financial loss and allow you to fill your vacancy in a timely manner. CLICK HERE to get started!

What is the Expense of a Price Adjustment for your Orlando Rental Property?

In comparison to a vacancy, a price adjustment is much less of an expense. Most property owners prefer not to adjust the price because they believe the property can be rented for more. It is unlikely that your property will rent for the initial higher price if it has not rented or gained traffic within 20 or more days on market. Rather than holding out hope for the high price and continuing to take financial losses, a price adjustment will increase the success of your tenant search and allow you to continue earning a steady rental income.

Again, say your home is priced at $1,500 a month. The expense of a price adjustment for this home will come out to:

- $50 per month = $600 a year

- $100 per month = $1,200 a year

- $150 per month = $1,800 a year

- $200 per month = $2,400 a year

To compare the options of a continued vacancy or a price adjustment, take the example of the $1,500 starting rent and a $1,250 per month PITI.

- If you adjust the rent to $1,300, you are earning $2,400 less for the whole year

- If you keep the rent at $1,500 but your property sits vacant for 30 days, after paying your monthly bills, your expenses add up to $2,875 for just one month.

As an Orlando rental property owner, it is essential that you evaluate your options. Simply putting a number to the possible outcome really puts your potential losses into perspective. Renting your property for $1,500 a month rather than $1,300 a month may sound better upfront. In reality, the difference between finding a tenant right away and dealing with a 30 day vacancy will actually help you save and earn money instead of losing it.

How to Avoid Vacancies for Your Orlando Rental Property

There are many steps to take to avoid vacancies and ensure your property attracts and retains reliable tenants. A well-kept property and accurate rental price are two prominent factors that contribute to finding a tenant and filling a vacancy. Additional steps to take include:

- Professional property marketing

- Accurate listing description

- Pet-friendly policy

- Property upgrades

- Tenant screening

- Specified lease term

Managing an Orlando rental property on your own can be difficult as it requires knowledge of the industry and a significant time commitment. At The Listing Real Estate Management, our property management team is experienced and dedicated to guiding rental property owners to success and finding quality tenants.

One essential aspect of our job is to stay on top of rental trends specific to the Orlando market. Our property managers are well equipped to price your rental property correctly, and suggest price adjustments when necessary. Being flexible in rental price adjustments is the cornerstone of successful property ownership. Sometimes the market conditions allow for steep price increases, while other times, you may not be able to rent your property for the exact price you wanted to.

I understand the struggle to decipher between what is right for your property and what may hinder your personal financial success. That’s why we here at The Listing Real Estate Management are here to help you make those hard decisions. Our professional Orlando property managers have led hundreds of Florida rental property owners to financial success, playing a pivotal role in optimizing their income and financial returns.

Whether your property has been sitting vacant, or you’re unsure of the price in which to list it for rent, we can assist you in any stage of your rental property journey. If you have questions or you’re ready to get started, contact us today at The Listing Real Estate Management, your boutique property manager!

Copyright © 2017-2024, The Listing Real Estate Management. All Rights Reserved.