Renters insurance provides financial protection for an individual living in a rental property. There are multiple components of renters insurance which provide coverage for damaged or stolen personal property, legal liability, and additional expenses.

Acquiring renters insurance is an essential aspect of renting a home as it provides significant financial protection in the event of damage or loss by a covered peril. Each individual insurance policy outlines the covered perils, which typically include fires, weather related damage, lightning, water damage, theft and falling objects.

Navigating renters insurance can be overwhelming, but it doesn’t have to be. In this article we’ll talk about renters insurance explained by a professional property manager.

Personal Property Coverage

Personal property coverage protects a tenant’s personal property from damage or loss due to certain covered perils. Personal property includes items such as furniture, clothing, shoes, electronics, personal items, and personal appliances like air fryers or hairdryers.

It is a common misconception that renters insurance is an unnecessary waste of money, however, personal property coverage is priceless in the event of damage or loss. As a professional property manager, I advise Florida tenants to take inventory of all personal property and put a dollar amount to it. This will help determine the amount of coverage necessary to cover loss or damage.

To put it into perspective, the average monthly cost of renters insurance in Florida is $13.92, or $167.04 per year. In many cases, the total value of a tenant’s personal property far exceeds the amount of renters insurance. Renters insurance is a small price to pay in comparison to the value of your personal belongings and the expense of replacing or repairing them without insurance coverage.

Liability Coverage

Liability Coverage

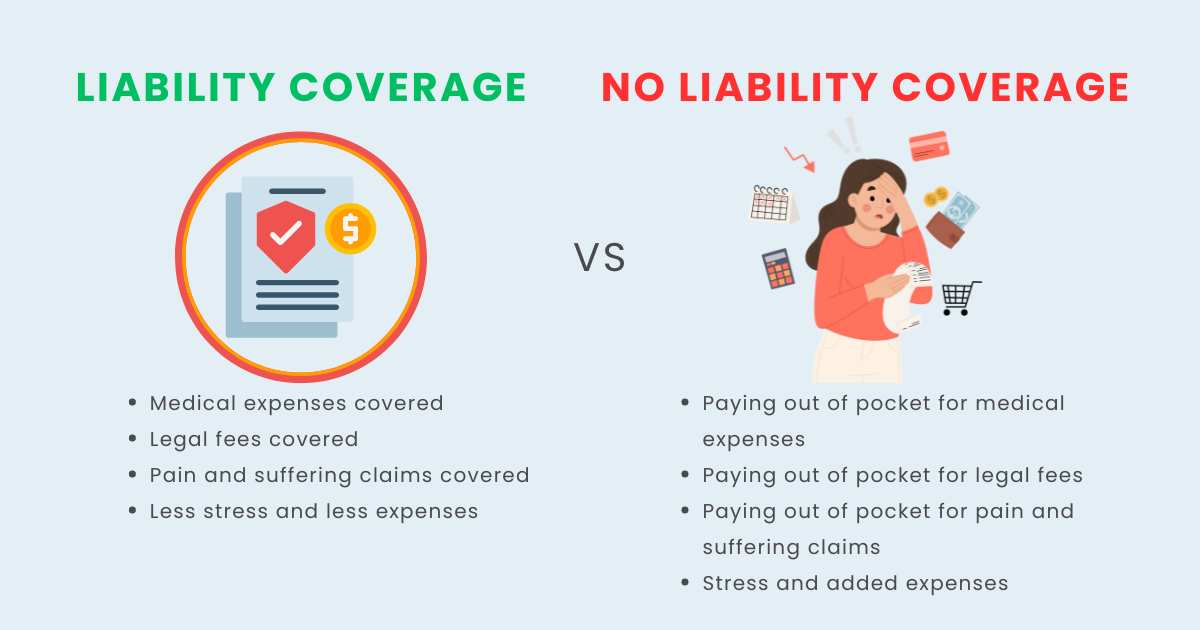

Liability coverage is a component of renters insurance that will cover the cost associated with being found legally responsible for an injury or damage that occurred on a tenant’s Orlando property. Liability coverage can include medical bills, compensation for wages of the injured individual if they are unable to work, and/or legal fees.

For example, say a shelf you installed falls and hits your guest on the head. Your renters insurance can help cover the cost of multiple aspects of the guest’s recovery such as:

- Medical bills for an ambulance or hospital visit

- Lost income if the guest must take time to recover and cannot return to work

- Claims for pain and suffering, compensation for the guest’s pain and discomfort

Unexpected accidents like this can happen, and not having renters insurance can result in significant financial and legal distress.

Additional Living Expenses Coverage

Additional living expenses coverage provides financial protection for temporary housing if a rental property becomes uninhabitable because of a covered peril like a fire or significant water damage. In this case, significant damage may require tenants to move to a hotel or additional rental property, resulting in an increase in living expenses. The additional living expense component of renters insurance will cover the cost of living in said hotel or additional rental property while the rental property is being repaired.

In addition to the cost of a temporary living space, renters insurance may also cover other living expenses that exceed typical spending because of the displacement. These expenses may include meals, laundry, transportation costs, or additional utilities.

Depending on the renters insurance policy, additional living expenses coverage applies for a limited period of time, with a specified monetary limit. According to Allstate, “The amount is typically based on a percentage of another coverage limit on your policy. For instance, if you have a homeowners insurance policy, your additional living expense limit may be a percentage of your dwelling coverage limit, the International Risk Management Institute explains.” Each individual policy may differ, therefore, it is essential for Orlando tenants to familiarize themselves with the logistics of the additional living expenses limits.

Common Misconceptions About Renters Insurance

There are many common misconceptions about renters insurance. Although some tenants see renters insurance as just another added expense, renters insurance is an essential financial protection when renting a home.

“Renters Insurance is Unnecessary”

Some tenants believe renters insurance is unnecessary because they don’t own anything valuable. However, personal property coverage is not the only component of renters insurance. Liability coverage and additional living expenses coverage help provide a safety net to tenants dealing with a legal issue or displacement. In the unique situation where a tenant is being sued or is forced to move because of a fire, a renters insurance policy will help save thousands of dollars in medical, legal, or displacement expenses.

“The Landlord’s Insurance Will Cover Me”

Another common misconception about renters insurance is that the landlord’s insurance covers the tenant’s belongings in the case of damage or theft. However, this is not the case. Although landlords do have insurance, their policy does not protect tenants. Landlord insurance offers coverage in favor of the property owner which protects the property and loss of income.

“Renters Insurance is Too Expensive”

Tenants often believe that renters insurance is too expensive. Without prior knowledge, the idea of renters insurance can sound intimidating and costly. Most people don’t realize that renters insurance is typically no more than $200 per year. In essence, this is a small price to pay to protect the overall value of your personal property.

How Do I Get Renters Insurance

There is a wide variety of insurance companies from which to purchase a renters insurance policy. A crucial step in acquiring renters insurance is assessing the value of all personal belongings. This will help determine how much coverage is necessary to ensure the policy covers potential loss or damage. Tenants should get quotes from multiple companies to compare value and choose the company that best fits coverage needs. While insurance companies typically offer similar renters insurance policy coverage and value, aspects such as limits and deductibles may vary between companies.

According to Forbes Advisor, the best renters insurances are:

Shopping for renters insurance may be overwhelming; there are hundreds of options and choosing the one most suitable for a tenant’s needs can be difficult. At The Listing Real Estate Management, we make the process easier. Our tenant benefits program allows tenants to acquire renters insurance directly in their individual tenant portal, offering a smooth and easy process.

Should I Require My Tenants to Have Renters Insurance?

As a Florida rental property owner, requiring renters insurance can help reduce stress and worry, but it can also support the success of your rental property. Required renters insurance helps property owners avoid lawsuits, reduce liability risk, and avoid confrontation. Essentially, if your tenants have renters insurance in the event of a covered peril, the blame and expense is taken off of the property owner and handed to the insurance company to deal with.

Renters insurance is a must-have requirement for tenants when owning an Orlando rental property. However, you should direct your tenants to consult a licensed insurance broker or provider.

Renters Insurance Advice from an Orlando Property Management Professional

While dealing with renters insurance may come across as intimidating, the process is fairly easy. Purchasing a renters insurance policy is highly valuable, and I strongly encourage all tenants to do so. You never know when accidents can happen— insurance coverage will save you from dealing with high expenses and consequences that come with not having coverage.

Whether you are a property owner or seeking a Florida rental property, do not hesitate to reach out to us with questions regarding renters insurance. Contact us today at The Listing Real Estate Management, our expert Orlando property managers are happy to help!

Copyright © 2017-2024, The Listing Real Estate Management. All Rights Reserved.